Whether you’re working as a solo financial advisor or as part of a larger team, it’s easy to get stuck in the day-to-day grind and lose sight of long-term marketing strategy.

But when you already work full-time supporting your clients on their financial journeys, there’s no time in the day to sit down and set marketing goals. That’s why our team went ahead and brainstormed some goals for you!

In this blog, we’ll walk through the top marketing goals for advisors who want to attract more clients, build long-term relationships, and grow their firm sustainably. These goals will help you clarify your message, focus your efforts, and align your marketing with actual business growth.

By the way, all of these goals come from our experience working with financial advisors like you. We’ve seen these strategies work, and we think they’ll be a great head start for you and your team, too.

Let’s dive in.

Goal #1: Clarify Your Brand Message

Why it matters: The average consumer is bombarded with over 5,000 messages a day. If your brand message isn’t clear and compelling, it gets ignored.

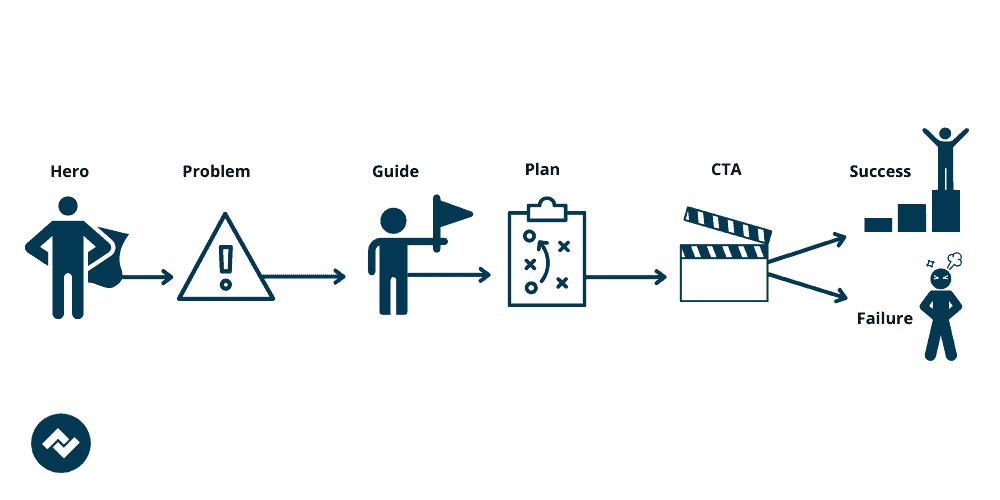

Action Step: Use the StoryBrand framework (we are big fans of it around here!) to articulate your value in simple, client-centric language. Instead of leading with how long you’ve been in business or listing your services, start by identifying your ideal client’s problem and how you help solve it.

Example:

Don’t: “We’re a full-service financial firm with 20 years of experience.”

Do: “We help successful professionals stop worrying about money and start building a future they can enjoy.”

Key takeaway: A clear message builds trust faster than a long list of credentials.

Want a full break-down of a clear brand message? Check out our blog post on StoryBrand Brandscripts.

Goal #2: Increase Visibility Through Thought Leadership

Why it matters: Advisors win trust by demonstrating expertise. But people can’t trust you if they’ve never heard of you.

Action Step: Develop a content plan that includes SEO blogs, LinkedIn articles, and occasional speaking engagements. Focus on topics your target audience is actively searching for, like retirement readiness, tax-smart investing, or managing sudden wealth.

Pro Tip: Use tools like Google’s Keyword Planner (it’s free!) to find what your audience is actually searching (e.g., “retirement planning checklist,” “how to save taxes as a business owner”).

Repurpose your content across platforms:

- Blog post → LinkedIn article

- LinkedIn post → Email newsletter

- Webinar highlights → YouTube Shorts or Reels

Key takeaway: When your name keeps popping up in valuable, relevant content, trust begins before the first meeting.

Need more tips on how to write a great blog? We happen to have a, well, blog for that!

Goal #3: Define Your Ideal Client Profile

Why it matters: Generic marketing doesn’t convert. Your ideal clients want to feel like you get them.

Action Step: Create a clear client persona:

- What do they do for a living?

- What life stage are they in?

- What financial fears or goals keep them up at night?

For example, instead of saying “We help people plan for retirement,” say “We help dentists nearing retirement structure their exit and protect their legacy.”

The more specific your targeting, the more powerful your marketing becomes.

Key takeaway: Speak to someone, not everyone.

Want more tips on identifying your ideal clients? Check out this blog on the topic!

Goal #4: Build a Lead-Generating Website

Why it matters: Your website isn’t just a digital brochure—it should function as your best salesperson.

Action Step: Ensure your website includes:

✅ A clear headline that explains what you do

✅ A simple call to action (e.g., “Book a Free Call”)

✅ Testimonials or social proof

✅ A lead magnet (e.g., checklist, guide, or quiz)

Pro Tip: Use tools like Hotjar or Google Analytics to track how visitors behave on your site. If people are bouncing off the homepage quickly, your message may not be landing.

Key takeaway: A great website doesn’t just look good—it drives action.

Need some tips on how to build a great website? We’ve got a helpful guide right here.

Goal #5: Build an Email Nurture System

Why it matters: Most people won’t hire a financial advisor on their first visit to your site—but they will give you their email if you offer them something valuable.

Action Step: Create an automated email nurture series that educates and builds trust over time. Start with a lead magnet (e.g., “5 Mistakes Professionals Make When Planning for Retirement”) and follow with a series like:

- Welcome email

- Client story or testimonial

- Education on your core service

- Call to book a free consultation

Tools like Mailchimp, ActiveCampaign, or HubSpot make this easy to implement.

Key takeaway: Stay top-of-mind by showing up consistently in their inbox with real value.

Want your emails to truly sparkle? Check out some of our email marketing tips.

Goal #6: Use Social Media Strategically

Why it matters: Social media isn’t just for younger audiences. LinkedIn and Facebook remain powerful platforms for advisors—when used intentionally.

Action Step:

- Focus on educating, not selling

- Share client stories (with permission)

- Use short-form video to humanize your brand

- Engage with comments and DMs to build relationships

Consistency beats frequency. Start with one platform and show up weekly with short, helpful posts. Don’t worry about going viral—focus on staying visible to the right people.

Key takeaway: Relationships begin in the comments.

Need some more pointers on great social posts? Check out our guide on using social media as a way of building your brand.

Goal #7: Track and Improve Key Metrics

Why it matters: Marketing without measurement is guessing. You need to know what’s working (and what’s not) to improve ROI.

Action Step: Set up dashboards or monthly reviews for the following KPIs:

- Website traffic

- Email open and click-through rates

- Social engagement

- Number of qualified leads per month

- Discovery calls booked

- Clients closed

Use free tools like:

- Google Analytics

- HubSpot CRM

- SEMrush or Ahrefs for SEO tracking

Key takeaway: What gets measured, gets improved.

Interested in what other metrics you should track? Check out our guide on key marketing measurables!

Goal #8: Build a Referral & Review System

Why it matters: Referrals remain the #1 source of new clients for most advisors—but most firms don’t have a formal system to generate them.

Action Step:

- Send a quarterly NPS (Net Promoter Score) survey

- Ask happy clients for reviews on Google

- Offer simple ways to refer friends (e.g., email templates or referral cards)

- Celebrate referrals with thoughtful thank-you gifts

Bonus Tip: Create a testimonial capture form and prompt happy clients right after major wins or project completions.

Key takeaway: Referrals happen more often when you ask.

Curious about getting more referrals? Here’s how to ask for them.

Goal #9: Humanize Your Brand

Why it matters: People don’t buy from brands—they buy from people.

Action Step: Make sure your marketing reflects your values, not just your services. Share behind-the-scenes moments, team bios, and community involvement. Use a conversational tone. Ditch the corporate jargon.

Clients want to know:

- Who are you?

- What do you stand for?

- Why should I trust you?

And they want to feel like you’re real, not robotic.

Key takeaway: Trust is built on authenticity.

Here’s some more helpful information on making your brand feel human.

Goal #10: Align Marketing with the Sales Process

Why it matters: Marketing isn’t just about getting more leads—it’s about getting the right leads to take action.

Action Step:

- Align your CTAs with your sales steps (e.g., “Book a Free Call” → Discovery Meeting → Strategy Session)

- Use marketing to pre-qualify leads by clearly stating who you serve

- Equip your team with resources to guide prospects from curiosity to commitment

At Hughes Integrated, we call this the “Blueprint Process”—helping advisors clarify their message, outline their strategy, and implement a plan to grow their firm. Your marketing should pave the way for that kind of clarity and trust.

Key takeaway: Great marketing makes selling easier.

Here are a few more tips on getting your process to work for you using the client journey.

Final Thoughts

Marketing for financial advisors isn’t about chasing trends or copying competitors—it’s about setting goals that align with how you build trust.

When you clarify your message, focus your efforts, and track what matters, your marketing becomes a growth engine—not just a guessing game.

Need help building a plan to reach your goals? That’s what we do at Hughes Integrated. From messaging strategy to full-funnel execution, we’ll help you turn marketing into measurable momentum.